Company car depreciation calculator

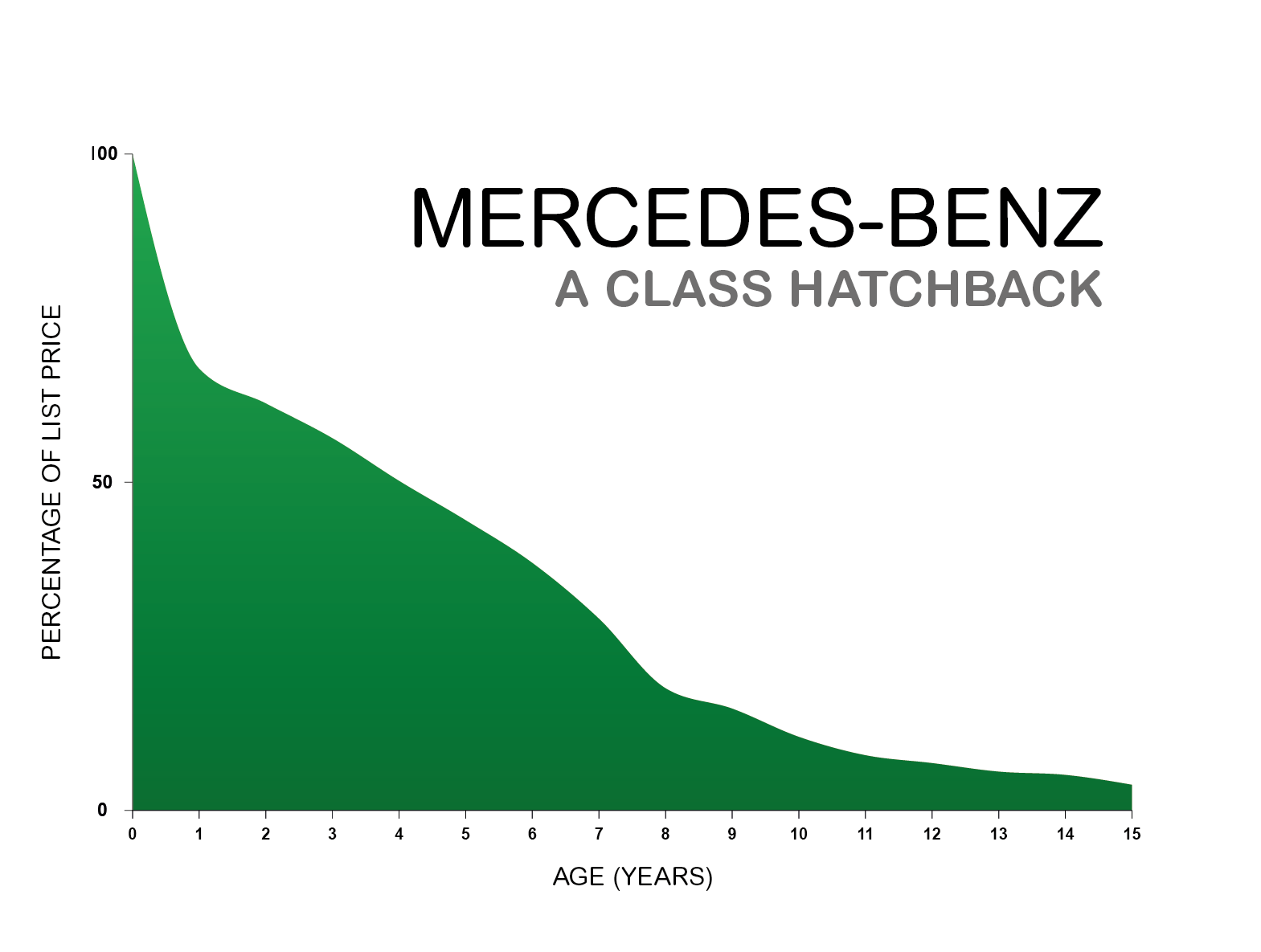

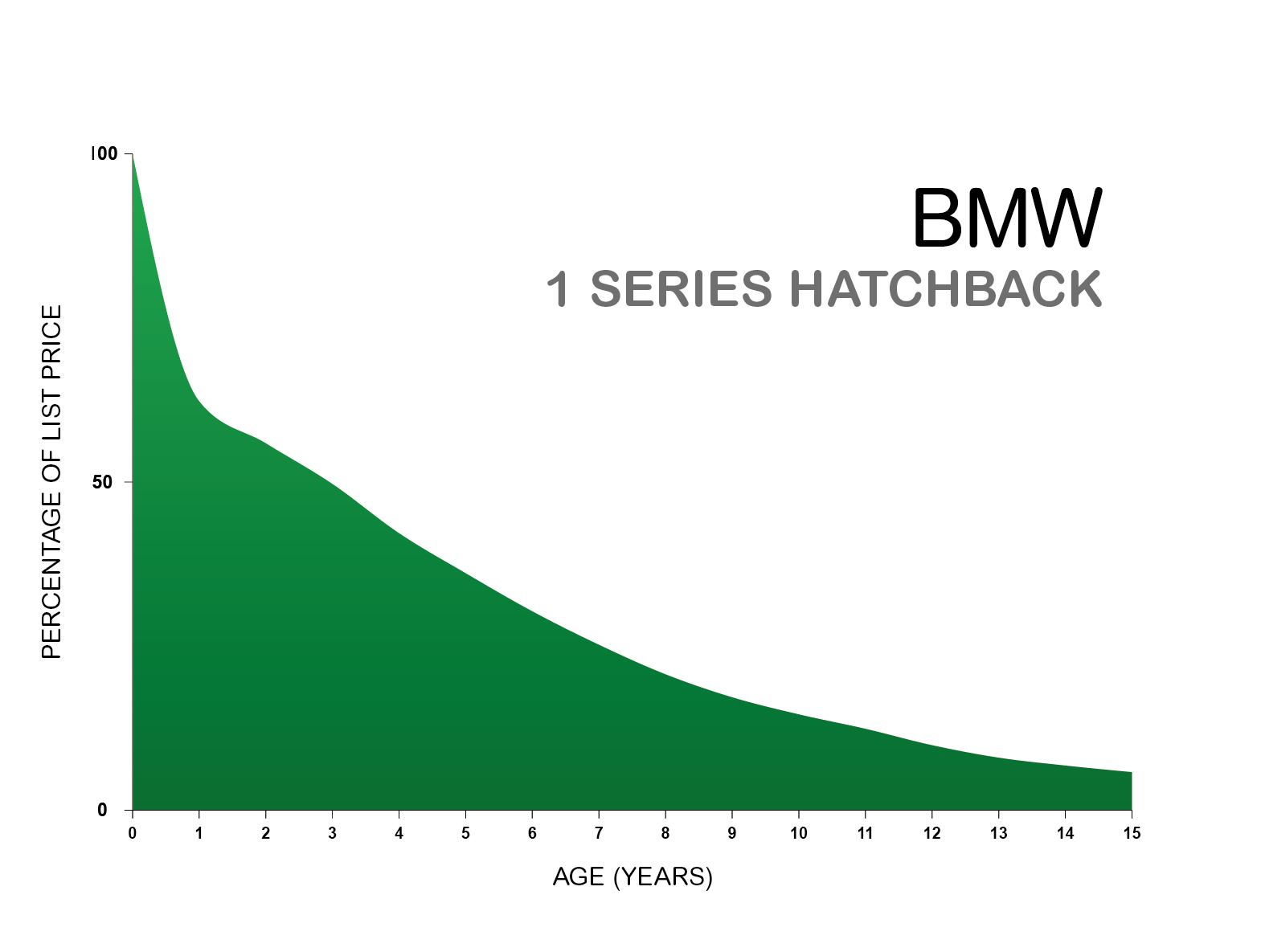

For a passenger auto that costs more than the applicable amount for the year the vehicle is placed in service youre limited to specified annual depreciation ceilings. Because of the rate of depreciation in new cars that we discussed in the above paragraph deciding to buy a car thats only one year old can save you upwards of 30.

Car Depreciation Explained With Charts Webuyanycar

Abarth 25 average 3 year depreciation Alfa Romeo 55 average 3 year depreciation.

. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8 years. Ad Receive Pricing Updates Shopping Tips More.

It can be used for the 201314 to 202122 income years. Up to April 2021. You can generally figure the amount of your deductible car expense by using one of two methods.

You may wish to consult your own adviser regarding your particular circumstances. Such cars are treated as part of the general plant and machinery assets of the business and added to the overall capital allowances pool for the business. Car age current time expected to use in years A CCA TET.

Capital allowances are given at 18. If a vehicle is used 50 or less for business purposes you must use the straight-line method to calculate depreciation deductions instead of the percentages listed above. The capital allowances rate is 18 per annum for cars emitting 51-110GPKm.

Cost x Days held 365 x 100 Effective life in years Note also that where motor vehicles are concerned luxury cars have an upper depreciation limit. Car depreciation calculators These all work on similar principles to show roughly how depreciation affects individual makes and models of car. The straight line calculation as the name suggests is a straight line drop in asset value.

When its time to file your return youll use Form 4562 to report your cars depreciation. If you decide to buy a car thats two or three years old youre going to save even more due to the further depreciation of that vehicle. By using this car depreciation calculator you can get an estimate of what your vehicle may be worth in the future and take steps to make informed.

In fact the cost of your new car drops as soon as you drive it off the dealership lot. Use this depreciation calculator to forecast the value loss for a new or used car. Calculate Car Depreciation By Make and Model Find the depreciation of your car by selecting your make and model.

Its accuracy and applicability to your circumstances is not guaranteed. SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. If you qualify to use both methods you may want to figure your deduction both ways before choosing a method to see which one gives you a larger deduction.

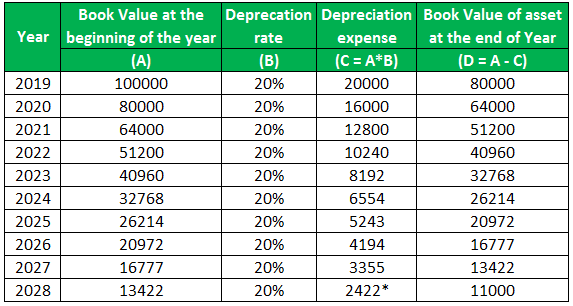

Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. By entering a few details such as price vehicle age and usage and time of your ownership we use our depreciation models to estimate the future value of the car.

Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership. You can then calculate the depreciation at any stage of your ownership. The standard mileage rate method or the actual expense method.

This calculator is for illustrative and educational purposes only. Depreciation Calculator as per Companies Act 2013. Can you get a bigger write-off upfront.

Many will also allow you to enter your numberplate for a more accurate valuation using available data from the DVLA to include mileage MOT results etc. Our estimates are based on the first 3 years depreciation forecast. Car Depreciation Calculator This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years.

Work-related car expenses calculator. To calculate the depreciation of your car you can use two different types of formulas. We have also built historical depreciation curves for over 200 models many of which go back as far as 12 years.

Eligible vehicles include cars station wagons and sport utility vehicles. The Rate of Depreciation in Used Cars. The calculator also estimates the first year and the total vehicle depreciation.

We will even custom tailor the results based upon just a few of your inputs. Use a depreciation factor of two when doing calculations for double declining balance depreciation. The algorithm behind this car depreciation calculator applies the formulas given below.

Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years. So 11400 5 2280 annually. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

The depreciation of an asset is spread evenly across the life. All you need to do is. Select the currency from the drop-down list optional.

Select a Vehicle MakeManufacturer from below to see all models we have data for. It is fairly simple to use. Before you use this calculator.

- Total car depreciation for the time it is used C sum of the depreciation year per year for the given TET considering that the annual depreciation for year n is 1075 from the. Prime Cost Method for Calculating Car Depreciation Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value Under this method the calculation of depreciation is based on the fixed percentage of its cost. The existing capital allowances pool is already at 100000.

Car depreciation refers to the rate at which your car loses its value from the first year you bought it.

The Depreciation League Table Different Countries Different Values Fleet Europe

Car Depreciation Calculator

Annual Depreciation Of A New Car Find The Future Value Youtube

Car Depreciation Chart How Much Have You Lost Infographic New Cars Financial Tips Two Year Olds

Depreciation Calculator Definition Formula

Depreciation Rate Formula Examples How To Calculate

Download Depreciation Calculator Excel Template Exceldatapro

Car Depreciation Rate And Idv Calculator Mintwise

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Vehicles Atotaxrates Info

Car Depreciation How Much Value Have You Lost Masterpole Murphy Insurance Agency Syracuse Ny Independent Auto Home Life Business Insurance Agent

How Much Is Car Depreciation Per Year Quora

Volvo Depreciation Numbers Examples You Should Know

Free Macrs Depreciation Calculator For Excel

Car Depreciation Explained With Charts Webuyanycar

Auto Finance Calculator With Trade Fresh Car Depreciation Calculator Calculate Straightline Car Payment Calculator Car Payment Car Loan Calculator

The Depreciation League Table Different Countries Different Values Fleet Europe